Quantitative analysis informs on the economic impact of the project

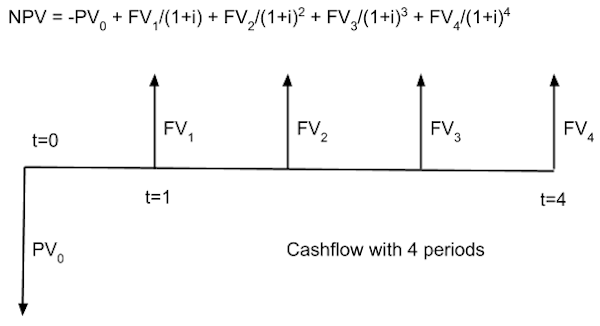

Viability Analysis is a study to understand if a project can bring a positive contribution to the bottom-line, generating a positive present value from a cashflow of future payments:

Project performance can be measured in terms of:

These indicators are calculated based on CAPEX (capital expenditure) but OPEX (operational expenditures) must also be considered when considering the long-term viability.

These are the most common criteria for short-term impact. Some companies (eg. Amazon) decide to enter new markets considering the potential to gain market share that is more important in the long-run (because it can impose higher prices and sustain margins).

It is a challenge to associate the right short-term KPIs to monitor long-term objectives, but this is the best way to decide on the merits of a project when you can afford the time to get there.